Mostbet  az

az

The Automated Deposit Tax

A System for the Complete Funding of the Federal Government

Using Certified data published by the Bank of International Settlements, provided

by the US Federal Reserve and Treasury

1) The entire 2015 Federal Budget could have been funded with an excess;

2) ALL Federal taxes, regulatory and excise fees for individuals and business

including income, could have been replaced;

3) Individual and business interactions with the IRS and all tax retuns could have been eliminated;

By charging a 1% FEE SOLELY ON DEPOSITS into certified financial institutions in the USA.

You are invited to review this revolutionary website for detailed explanation and discussion.

THE NEW ECONOMIC NORMAL? …………NOT A CHANCE!

The Impasse: after 60 years from the last Great War that destroyed so much of so many countries. We progressed from building back the destruction, then finding new technologies which advanced our capabilities in so many vital areas. We built great economies with high productivity. Unfortunately, our "success" had some tough unintended complex consequences resulting in increasing numbers of people under-employed, under-educated and dependent on a compassionate government. People's hope for success in the future has dimmed while many have seen opportunities for success expand. Demographic changes of years of decreased birth rates and changes in the consumption level of aging/retiring populations have altered the assumptions for growth. As these growth assumptions have declined by over 50%, the debt of many countries, major banks and insurance companies have come into question. The "house of cards" has made the once proclaimed economic exuberance into perennial worry.

Stagflation – That’s where we are, coined back in the late 1970’s, it is a time of very low growth; too low to keep up with the needs of society; yet not negative growth. The really smart people argue endlessly, “Is this deflation or inflation.” It is neither. It is stagflation. The result of central banks desperately trying to keep a nation out of deflation by distributing/printing money creating a counter force of inflation in a generally failed attempt to grow the economy while paying off the debt using cheaper currency. But, they cannot get there using this technique, so we are stuck with brutal and stubborn stagflation. Fewer jobs are created than needed, and most of those created are far below most people’s expectations. Political incumbents are paralyzed in the Executive, The Congress, The Fed and central banks around the world. The people know the Emperor has NO CLOTHES and his old tools can’t do the job.

Those old tools of raise taxes/cut taxes; increase spending/cut spending; raise interest rates/cut interest rates; just won’t work anymore and every action has the potential of serious unintended consequences both domestically and increasingly internationally. So we sit while our presidential candidates can only act like kids in a school yard picking fights and calling names. The folks ask for a discussion of issues and solutions – but there are none, so continuing the grand distraction is the strategy. No new fixes. The monetary tricks are easy, because they are applied virtually by edict, and then they are stretched to the limit and exhausted. The fiscal tricks are no longer practical/possible because they actually require “cutting”, sacrificing benefactors’ favorite hand-outs; and, of all things, voting. With the need to fill every 24 hours with a new controversy in the news cycle, those things aren’t going to happen. So the “smartest people on earth” are chasing their tails inside an old fashioned box. Obviously, it is going to take something REALLY different to get us out of this degenerating, downward spiral.

And that brings me to the Auto Deposit Tax (ADT) or 'The Tiny tax'

The Way Out- Maybe the only way out that will build people up and create new opportunities without re-distributing or penalizing anyone…..…The way out for the governments of the world and collective society. Individuals will find the hope that all humans need to be productive contributors to society and have a chance to clearly see personal opportunities and a means to better ment which frequently leads to happiness and fulfillment in this life. The alternative is to be a university grad with no job and no idea of how to face the future or relying on the government for sustenance.

The Tiny Tax- Take the largest manageable tax base rendering the lowest possible rate which for the USA is ... 1.0%. Then make the tax collection automated with no required returns and minimal rules. Most critically, replace all other forms of taxation at the national level. Such a tax is described below and would revolutionize business, economic policies and people’s lives at all levels of society.

In the past it has been called the Tobin Tax, and various other real applications have been tried in Brazil, Argentina, and Australia. The concept was found very efficient, but eventually dropped because it was only ever used as an additional, “add-on the top” tax and the privileged in the countries could not evade it.

A first attempt at total replacement of Federal income tax was proposed by Professor Edgar Feige in 2001 as the Automated Payment Transaction Tax (APT). After studying Dr. Feige’s work and presenting it in live forums, blogs and through the apttax.com website for ten years, I decided that using ALL transactions was unnecessarily complex, especially with serious issues in the security markets. Modifications were made and the Automated Deposit Tax or Auto Deposit Tax (ADT), as described below, was the result. I prefer the simple name of “Tiny Tax”.

The “Tiny Tax” Code

June 2015

1. A total replacement for ALL forms of Federal taxation and excise fees.

2. A tax on all deposits into qualified business and personal financial accounts, and transfer of ownership of property and other assets, only if full cash value is not paid.

3. Taxes paid immediately by software in financial institutions that place funds

anonymously in Federal accounts.

4. No Federal Tax Returns.

5. No exemptions, deductions or issues surrounding definition of income.

Revenue collection only, NO socioeconomic engineering by tax code,

NO special interest favors.

6. Tax rate to cover all 2015 Federal expenditures, without deficit, is estimated at 1.0%. (See derivation below)

7. No taxes on security or derivative trading "within" accounts ONLY on entry in and

on exit, with deposit into another account.

8. Money transferred to a non-US account or wired out of the country is taxed.

9. No involvement of IRS in individual and business matters. IRS only involved with financial institution adherence to collections, tracking very large transactions

especially those involving foreign accounts, and qualifying charities as below.

10. No tax on SS deposits to individuals. No tax on deposits into accounts of only those charitable organizations qualifying under the 501 (c-3) definition.

William Hermann, MD of Texas

autodeposittax@gmail.com

(Page 1 of 1 NOT 1 of 70,000)

www.thetinytax.com

www.autodeposittax.com

Derivation of the Tax Base and Rate

for the Automated Deposit Tax

1) Total "payment" transactions in the US economy, debits and credits in financial accounts or banks and trackable institutions (excludes inter-government transactions and those confined within the Federal Reserve System) based on certifed data of year ending 2014 by the Bank of International Settlements: 1.308 Quadrillion USD

2) Total of all contract payments (stock, bonds, derivatives and futures):

1.307 Quadrillion USD

This is adjusted by subtracting 60% of the total to eliminate the intra-account security and derivative transactions since inside account trasactions are not taxed:

40% of 1.307 Quad.

Total = 0.522 Quad. USD

Total GROSS ADT Tax Base (#1 and adjusted #2):

1.308 + 0.522 = 1.830 Quadrillion USD

Then to derive the actual estimate base available to collect tax on, we adjust as follows:

First, subtract 50% as only credits/deposits not debits are to be taxed, leaving:

915.0 Trillion USD

Lastly, arbitrarily subtract another 50% to account for changes in behavior such as expansion of the use of cash and diminished transfer activities between accounts, leaving:

458.0 Trillion USD

On which 1.0% is applied resulting in receipts of:

4.58 Trillion USD to cover a current budget of 3.9 Trillion USD

Additionally, the use of an automated transaction tax is expected to save an additional 0.4 Trillion USD per year in compliance and enforcement budget savings.

Reference: Bank of International Settlements, CPMI/Redbook Statistical Update for 2014, Published December 2015

In comparison to the other tax plans...

1. The FORBES FLAT TAX (approximately 15% on income) still requires the IRS to determine WHAT IS INCOME? That is a big deal when you think about all the ramifications of that determination – it becomes the basis for the most serious investigation and compliance actions.

2. THE FAIR TAX (23% Sales Tax) does eliminate the IRS for individuals, BUT IT DOES NOT FOR BUSINESS, and that's where 95% of the tax ‘tricks’ lie. Fair Tax creates a huge bureaucratic process of distributing money too virtually everyone every month as so call "pre-bates". The high percentage rate on all purchases (with state sales tax it may reach 30%) hits hard at the heart of the economy - consumption.

THEN THERE IS …….

3. THE “TINY TAX” eliminates these issues and all the IRS activities that disrupt and threaten personal lives and businesses. The Tiny Tax only collects money by software in financial institutions. It leaves socio-economic engineering up to separate legislation.

Frequently Asked Questions

by William J. Hermann, Jr. MD

1. What is the source of the data used to calculate the ADT tax base? The validity of this data governs the entire concept.

The data is published every December by the Bank of International Settlements that is the repository of financial data from the central banks and governments throughout the world. This publication from the Committee on Payments and Market Infrastructures for the year prior. So the data available published last December in 2015 is certified for 2014 and is the basis for the calculations in this paper. Data is available for over thirty of the largest countries on earth. A table of the basics for several of these countries is included on this website.

2. In order to remain revenue neutral, bringing the same amount of money to the Treasury as under the current system, with very low individual rates, the progressivity gain necessarily shifts the burden to business. Will business not transfer the tax right back to the individuals and will the tiny rate of 1.0% per deposit be "cascaded" into a much larger amount as goods are assembled through intermediaries before the final pricing at the retail level?

The traditional system taxes either the individual or business at relatively high marginal rates and the tax code in its complexity adds additional compliance costs. Therefore there is an old concept that unless a business passes these taxes and associated costs on to the final price it is doomed for failure. Furthermore, if the tax is applied at every level of production then the cascading effect of every business passing along the tax will be disastrous at the retail level.

But, as I said, these concepts are fallacies when considered in the context of an extremely small rate. First, the wholesale "inflation" rate, as measured by the Producer Price Index, theoretically effects pricing at every point in the supply chain and that is typically 2 TIMES the ADT rate. The reason these price increases don't cascade is that the market price will not always tolerate such "automatic" increases. So companies are forced to lower costs and become more productive to combat "inflation." This activity has spurred innovation and achieved our economic leadership.

Secondly, the idea that the tax will be automatically passed through is wrong from a market perspective. All business throughout the supply chain will experience significant tax and compliance cost reduction as well as the loss of the employer FICA payments. The removal of these taxes, tax strategizing, and compliance requirements will reduce business costs by more than 15%. Therefore it is likely that even if the 1.0% tax is added back, the net is still a very large favorable balance which will interrupt any cascading effect.

3. How does the ADT Tax base relate to the current income and FICA tax base?

The ADT actual estimated tax base after cutting it 50% to account for unforeseen avoidance techniques is still roughly 14.2X larger (32.2Tr. current base vs. 458 Tr. ADT base).

4. Who would oppose such a universally beneficial concept?

It is a very small group (but they too "all" pay taxes) whose livelihood and career is based primarily on our unwieldy tax system eg. H&R Block, Inc., IRS employees and others working in the collection side of state and federal government, attorneys and accountants that primarily deal with form submission and very basic issues of taxation. There will certainly be a multi-year transitional period.

The truth is virtually anyone opposing this universally beneficial tax plan will have an obvious selfish interest which will be clear in their arguments. Such selfish interests will not provide a basis for all citizens to continue to pay 70 to 100 TIMES more taxes than they have to while continuing to file forms and live under the specter of the IRS.

Inflation: The stimulatory effect of returning these tax dollars (gradually) to the consumer will create robust growth and job opportunities should abound. It is this growth, saving and investment that will increase tax revenues without increasing the tax rate.

5. Wouldn't there be a (further) loss of discipline among politicians who, once they swallowed the big change from the current system, would realize that they could increase government spending considerably with infinitesimal increases in the tax rate?

Relatively large programs would require only at the one-hundredth decimal place increase and government would grow that much further... Even the multiplier effect on the economic growth expected from adoption of the ADT system will fill the government coffers without a rate increase. We would hope the public rhetoric would serve to control this political urge, and considerable progress on reducing the national debt could be made, but in the long run this is obviously NOT a reason why we must all continue to pay 100 times as much in taxes as necessary to fund the government. With the ability to expand the budget/receipts by 500 billion USD (12% of our current Federal budget) for every 0.1% tax rate increase, the public must be vigilant.

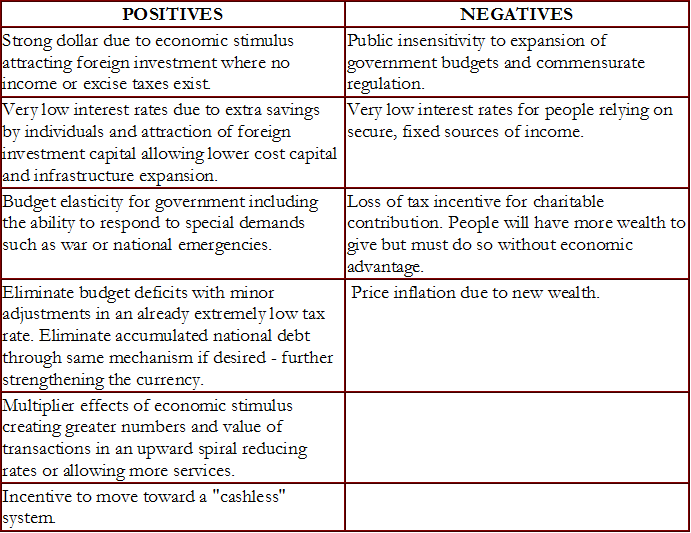

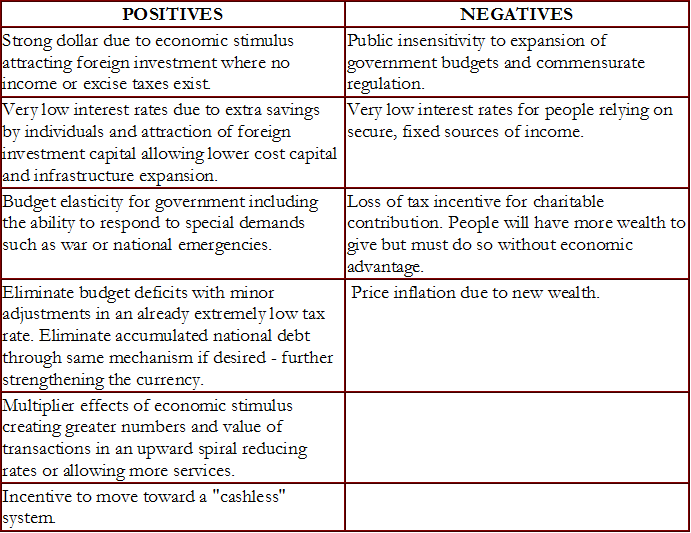

6. What are some of the positive and negative ramifications of a change to the ADT Tax?

Some that come to mind are listed below. As with any major change what is viewed as positive for one group may be considered a negative for another. A few of these ideas are listed below as points commonly raised in discussions:

7. Isn't there a big loophole around the ADT Tax by simply using cash?

Because the tax is on the deposit side, use of cash is a burden to those receiving it and not any advantage to those paying with it. Accumulating cash outside of a financial institution can be dangerous and it is anticipated that few people will go to the trouble to save 1%. In 2014 the use of cash was confined to consumer payments and represented 188 billion USD of the 458 trillion USD ADT transactional tax base (0.04%).

8. What has been the experience of current and past transaction taxes in other economies?

First and foremost, there has never been a complete replacement of a federal tax system by a transaction tax. All have been add-on taxes to create fast revenue. For example, the add-on tax in several South American countries such as the largest, Brazil, had only moderate acceptance simply because it was in addition to already high taxes with no relief. Therefore, problems such as the cascade effect described above are present. A similar experience was seen when the "turnover tax" was attempted in Europe following WWI. However, in this latter case several other severe negative influences were also present. In Australia, a transaction tax was tried at the state level without federal participation. Rates and their application were not uniform, and, once again, it was an add-on tax. Now the Democrats are putting forth a Financial Transaction tax on all security and derivative trades. It is a very low rate at 0.03%, but it will have an effect on the markets due to the disincentive for high frequency/high volume trading. This Democrat proposal is yet another “add on the top” tax as it does not replace anything.

9. Is this an Ad or a political agenda?

NEITHER...This is a serious attempt to spread an idea that will significantly and favorably change everyone's life regardless of political persuasion or level of wealth. It is not commercial, it is NOT selling anything, and at this point it is not even trying to raise money (but would consider financial backing, if interested, due to the high cost of doing anything on a large scale). We are patient because we know that this small "fire" of an idea should spread by word of mouth and keyboard across the fruited plain rather rapidly. Remember even politicians pay taxes (most of them, anyway).

10. What about foreign transactions and funds coming into and leaving the USA?

Money leaving the USA by wire or check if payable to a non-US financial account or identifiable company or individual will be taxed. Money entering the country in any sizable amount will be deposited in a US qualified financial account and therefore be taxed, so foreign funds seeking a “low tax rate” home will be taxed as they come in (this category is expected to increase substantially). It is expected that monitoring foreign transactions will be a prime task for the “new” IRS, covering transactions from large inter-company to small Western Union wires back to the homeland. Withdrawals are not taxed except when moving money out of the country.

11. Now really, this seems too good to be true, where is the catch?

There is none of which this author has knowledge. The data used is public and part of the largest financial database in the world, The Bank of International Settlements (www.BIS.org) based in Switzerland (of course). The data is certified and therefore from 12 to 24 months old as this certification process takes time. While the tax is heavily weighted toward business and the wealthy, there are so many tangible advantages to this group, there is not a reasonable objection expected. Business of course can pass the Tiny Tax on to their consumers but because the rate is so reasonable, it is expected they would use the marketing power of saying they intentionally do not pass the tax on. For retail situations the discounts freely offered at 10 to 50% far out weight the Tiny Tax at 1%. Lastly, the Federal government will be able to abstract a small tax from the internet without having a major impact on the millions and billions of small purchases occurring and growing daily. The 1% rate will be far better than a federal sales tax of the usual 4 to 8% level. Then again, it would be reasonable to predict on-line vendors would use the marketing power of saying “Federal tax free” rather than worrying about 1%.

12. How will ADT work with credit card purchases?

Purchases are not taxed as they represent "withdrawals". Tax would be applied as payments are made to the account.

13. What are the limitations to having ADT be the one and only tax? How can State and Local taxes be included?

This is a tough policy issue since each of the states, local governments and school districts have always had the privilege of setting their own priorities and raising and spending a large portion of their receipts as they wish -- not to say there are not increasing Federal regulations dictating many “unfunded and funded mandates”. So how to allocate centrally collected tax monies is the sticking point as the largest part of the ADT tax base is national in scope. But the math is easy ….

Total State and Local Receipts from all taxes and fees in 2015 was 923 billion USD. As mentioned before every 0.1% increase in the Federal ADT rate will bring in at least 500 billion USD, so a rate of 1.2% would cover ALL taxes and fees collected by ALL governments in the USA.

ADT Around the World

Balancing budgets one Country at at time

United Kingdom 0.21%

Germany 0.38%

United States 1.0%

China 1.4%

Brazil 1.4%

France 1.6%

India 1.9%

Russia 3.6%

Mexico 4.0%

Italy 4.4%

Japan 7.8%